The Greek economy

The Greek economy

THE CURRENT ECONOMIC ENVIRONMENT IN GREECE AND THE INVESTMENT OPPORTUNITIES

The Greek economy began with optimistic mid-term prospects in 2020 as a continuation of the pattern over the last three years, ending with 1.9 percent real GDP growth in 2019.

In addition, the unemployment rate declined to 16.4% of the labour force in January 2020, almost the lowest in the last nine years, with jobs recovering 36.3% of its losses in the crisis period from the tourism, trade, manufacturing and public sector sectors.

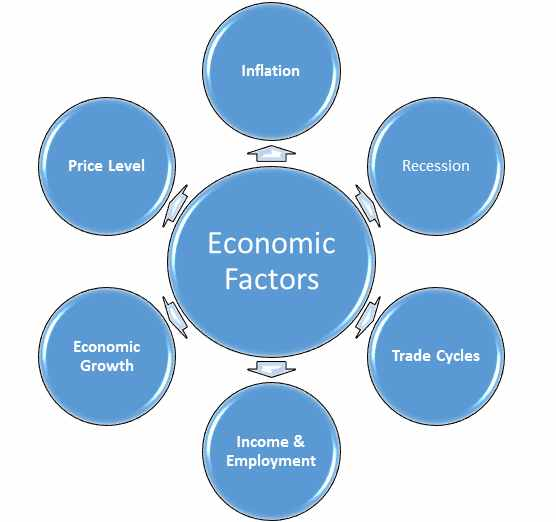

Inflation fell from 0.8 percent in 2018 to 0.5 percent in 2019, owing to the decline in VAT rates on some types of products and services and the fall in oil prices.

The Economic Climate Index reported its highest value since January 2001 in February 2020 and its highest level of consumer trust since August 2000. Reductions in the borrowing costs of the Greek government, positive reviews & upgrades by international credit rating agencies and the willingness of policymakers to introduce steps conducive to medium-term development, with an emphasis on tax cuts and institutional system reforms, have had a positive effect on the recovery of the economy.

The COVID19 pandemic then exploded and triggered market volatility, not only in Greece but worldwide, due to the lack of clarity of the lockdown measures and the second wave, the length and magnitude of the fiscal and monetary support measures and the effect on consumer demand, the supply chain and investor behaviour in the post-crisis period.

Overall, Greece is more vulnerable than the average EU country to the demand and supply shock of the COVID-19 crisis due to a number of structural factors, including greater exposure of GDP to tourism and transport, a greater share of self-employed and micro-enterprises in the workforce and a lower penetration of information and communications technology.

The reforms begun under the third Economic Adjustment Program continue and some of them are progressing smoothly, others less so, although the COVID-19 crisis has undoubtedly led to delays in both the reform and privatization programme.

Generally, however, the commitment of the current government remains high, although the necessity of delivering some services digitally, due to coronavirus, has led to the rapid adoption of digital devices by the state and companies, and hastened public familiarization.

As far as the privatization program is concerned, there has been an increase in mobility before the COVID-19 crisis , especially in the energy sector, while progress has been made in projects such as AIA, DEPA Commercial, DEPA Infrastructure, Hellinikon and 10 regional ports and slower progress has been made on Egnatia Odos, EYATH and EYDAP.

Furthermore, in the coming months the perfect timing to invest in Greece shall be due to the following reasons:

1. The management of the pandemic in Greece is expressed in the relative health results. Indicatively, the number of deaths per million people in the EU is among the lowest. Academic research has shown that the quicker the recovery of the economy is, the better a nation handles a pandemic.

2. The Greek economy had a strong positive momentum before the crisis erupted, as the projected pre-pandemic growth rate for Greece was 2.4% compared to 1.1% for the euro area in 2020.

3. The industrial sector has done comparatively better than the euro region. Industrial production in Greece has risen faster than in the euro area on average since mid-2016. Since January 2020, the fall in industrial output in the euro area has been three times higher than in Greece. The relative resilience of the Greek industry is possibly linked to the fact that Greece is not deeply integrated into the Global Supply Chains as a traditional euro area economy. In addition to that, composition matters. Food and pharmaceuticals, for example, have outperformed during the pandemic, backed by strong external demand and low income elasticity.

4. Greece gained most from the two decisions of the ECB. Granting a "pandemic" waiver of Greek government bonds to be used as collateral for Eurosystem refinancing operations and the inclusion of GGBs in the Pandemic Emergency Purchasing Program (PEPP) helped minimize the spread of Greek government debt to pre-crisis levels, thereby improving the funding conditions for banks and non-financial companies. However, some of the legacy issues (strong public debt, high unemployment, high NPL and wide expenditure gaps) of the 2010 debt crisis are likely to worsen dramatically as a result of the coronavirus pandemic.

Autor: Yacine Bougrassa, CEO, BKMS Family Office